My Stock-Bond-Volatility chart says it’s time for Volatility – despite the future VIX board disagreeing, the large VIX structural short clearly against me not to mention the 1:5 UVXY stock split tomorrow. As mentioned in my Live Trading Room this morning, Volatility looks good long – At least for a trade. And wouldn’t you know, VIX closed up 13% today even before the Trump announcement tonight that the Tariff rate on $200 billion of Chinese imports will start at 10% then go up to 25% by end of year. Effective date September 24, right before FOMC meets – ha! Subtlety is not Trump’s strong-point.

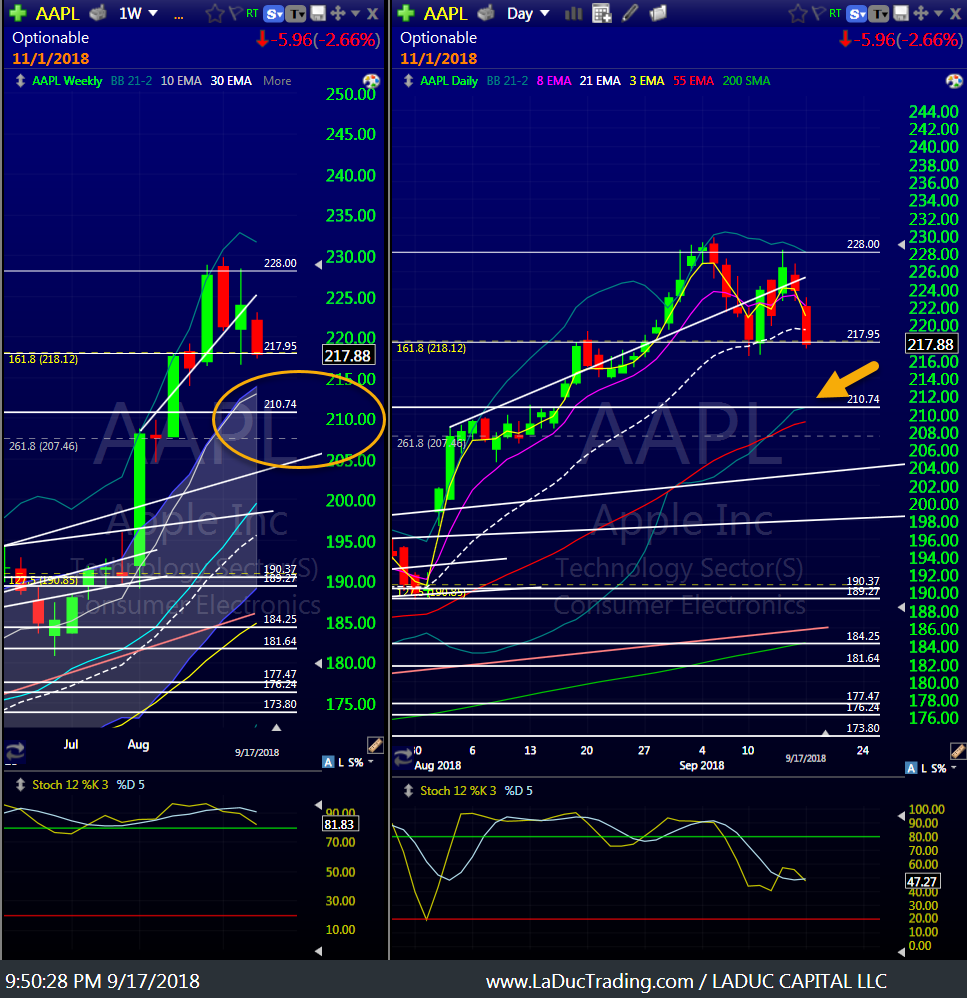

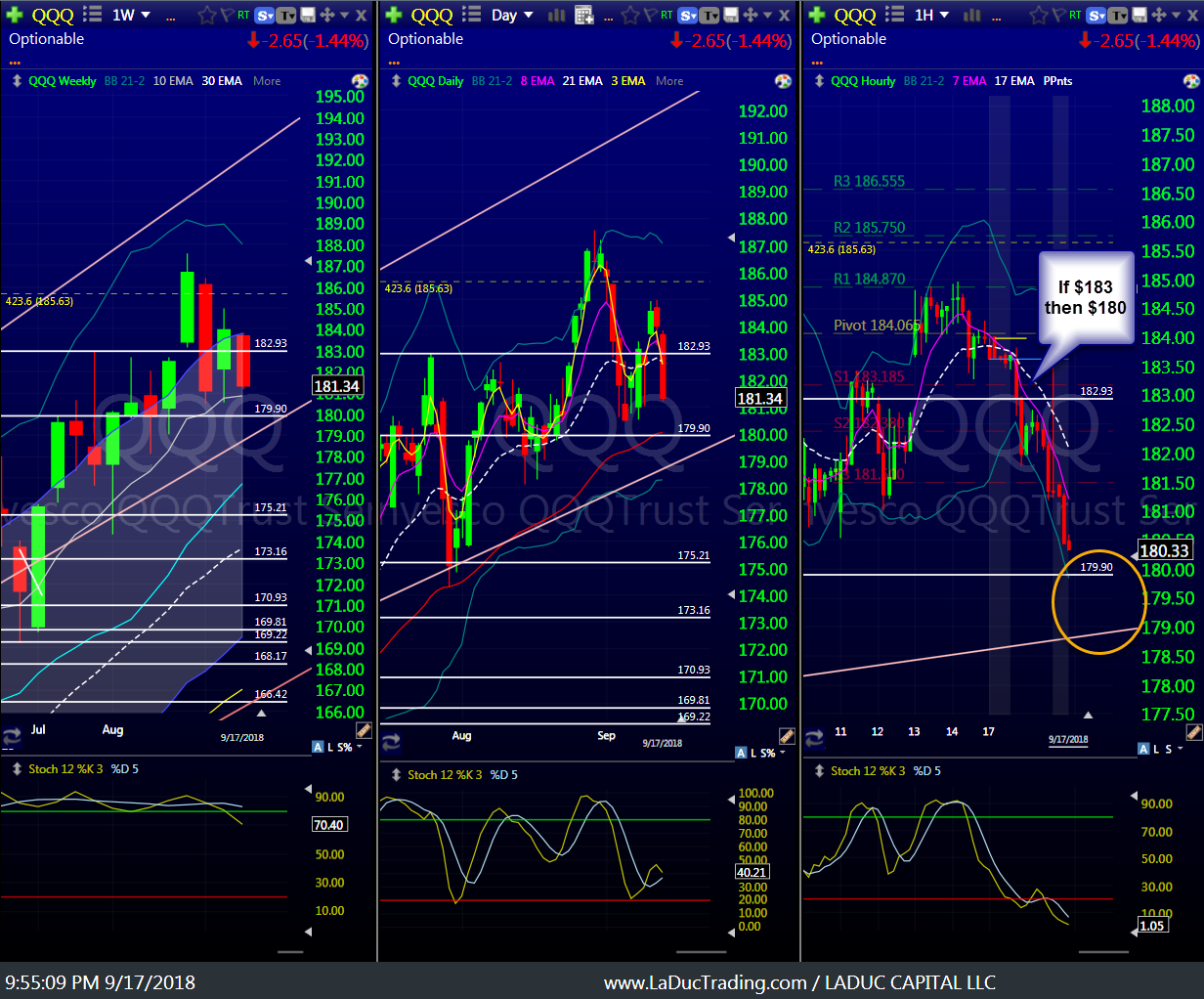

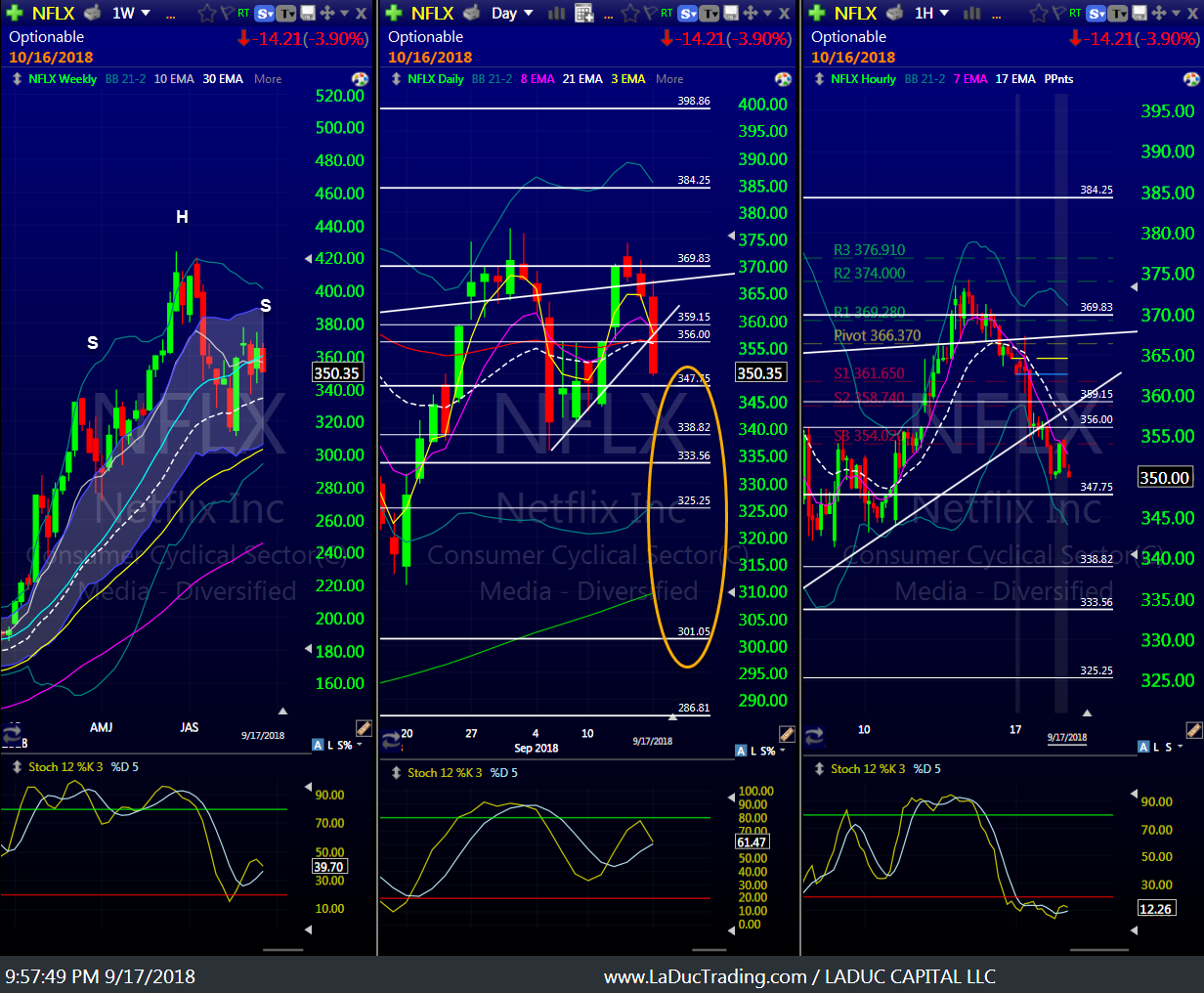

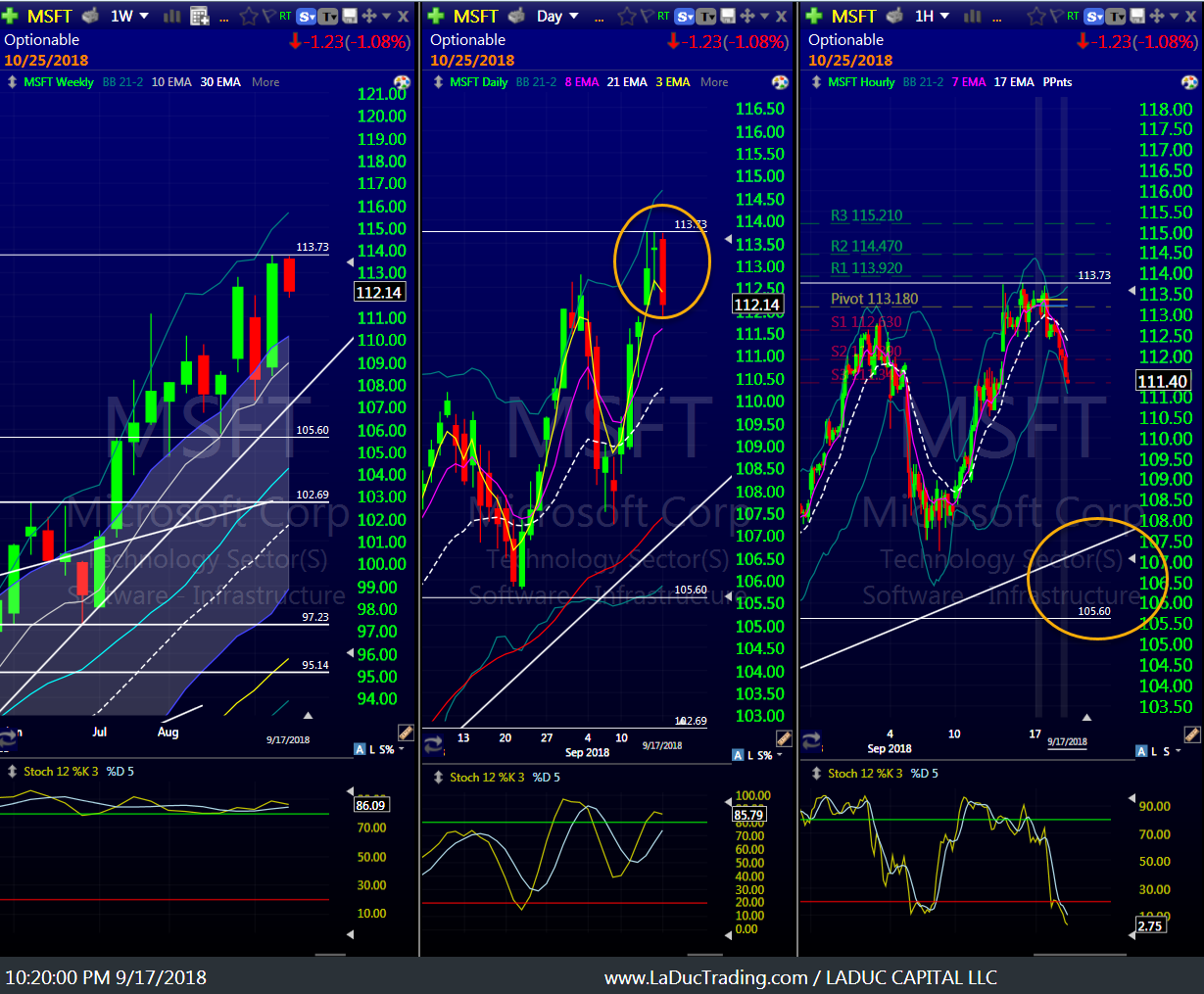

Here are some Short Trade Setups to consider:

The Big Tell – other than Rates and Volatility Spiking – would be the degree of selling in Nasdaq stocks. Right now the NASI is clearly rolling over but it is not below the 0 line so the bullish Trend in QQQ has not broken – yet.

But here’s what could flip it.

If rates continue to spike, as I suspect they will (and have been calling TNX #RateSpike since 2.8%), then this Bull Steepener will cause a Rotation into Value Plays and out of Momentum (think FAAMNG!). It’s happening already. We have followed XLP and related plays since April. We have actual selling in FANG stocks since FB’s faceplant on earnings. If the 10-year continues to run higher into 3.3%, momentum will turn down even more and the NASI will be ‘below the fold’ which becomes Bear Correction territory.

With that, don’t forget to hedge!

Samantha

Thanks for reading and please consider joining me in the LIVE Trading Room where we work through Value and Momentum trade ideas and set ups every trading day.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in.

More Macro: @SamanthaLaDuc Macro-to-Micro: @LaDucTrading