The Dollar and Euro

Last time I was on TD Ameritrade April 24th, I was bullish the US Dollar. The chart I posted then had DXY at $90.07. My price target was $95 and it hit $94.97 which happened to correspond to the 200 moving average. With ECB potentially ready to wind down their QE program, the Euro could rally (after a kneejerk USD spike), causing USD to pullback to $92 area. After that is another question and much depends on Draghi not Trump or Powell.

Eurozone inflation jumped to 1.9% in May from 1.6% and since inflation dynamics lag by a good 3-6 months, it makes sense the ECB get in front and manage expectations to avoid surprises – in bond yield, inflation and/or Euro spikes. ECB is slated to do just that at their next meeting.

Given the Euro’s decline this year from $1.25 to $1.17 area, this is not a bad time for the ECB to announce the gradual reduction to removal of the asset purchases program. As long as the US remains on the path of raising interest rates, the euro shouldn’t rise too fast against the USD. Still, I see weakness in the Eurozone continuing since ECB announced in October 2017 it would cut QE by half through September 2018. There has been a series of underwhelming econ data (Eurozone industrial output, U.K. factory output et al ) just as ECB plans its exit. This is a monthly chart with a retest of the wedge breakout area likely this year.

Gold and Miners

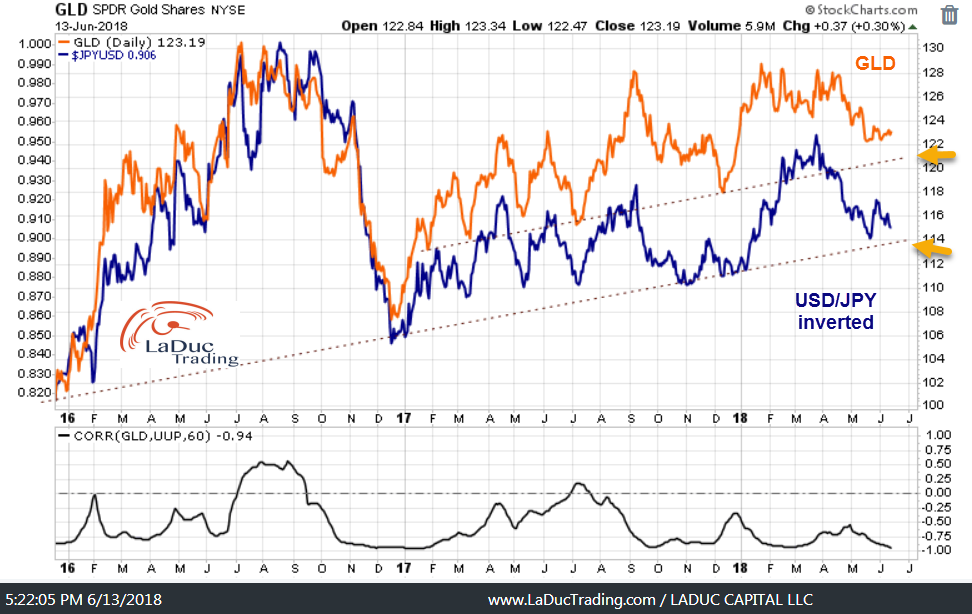

Gold side-by-side with (inverted) USD/JPY is foretelling. With that, Gold has yet to ‘take off’ despite the Fed allowing inflation to run towards 2.3-2.5% (it was 1.4% last summer and Fed still raised). Point is: it’s getting close – both to my downside price targets and potential reversal area.

Gold Miners, on the other hand, are intonating a big move is coming – judging from the price compression/squeeze/coiling action in price the past year and a half. Also, contrary to belief, Fed hikes have been bullish Gold Miners.

Make Room for Value

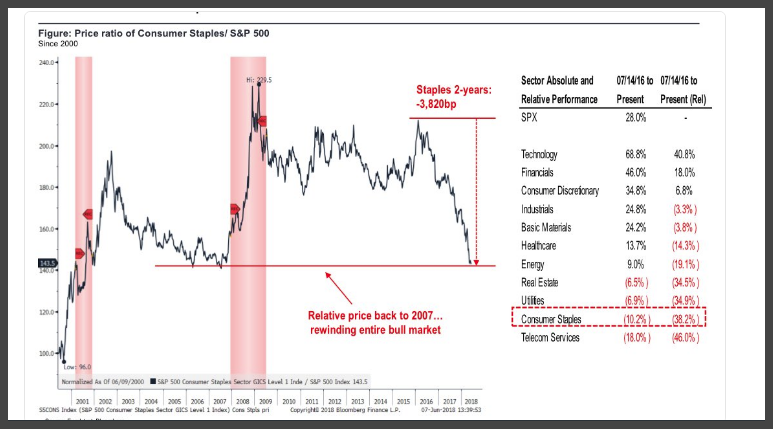

Value stocks in the form of Consumer Staples are oversold and have undergone a massive P/E compression so much so that the relative value of value stocks is back to 2007 levels. When compared to growth stocks, with a winner-take-all environment, value stock returns have been depressing. In a low-rate environment, it makes sense growth outperforms value as investors are willing to ‘pay up’ for future growth. Value vs Growth is at a 28 year low! And down 10% this year. Wait for it…It’s early, but I believe it’s turning now – early 1st inning.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in. Twitter: @SamanthaLaDuc @LaDucTrading