The LaDucTrading Gone Fishing Newsletter is divided into basically three parts:

- Reflections and Inflections

- Events This Week and How I’m Trading It

- Macro Considerations

Reflections and Inflections

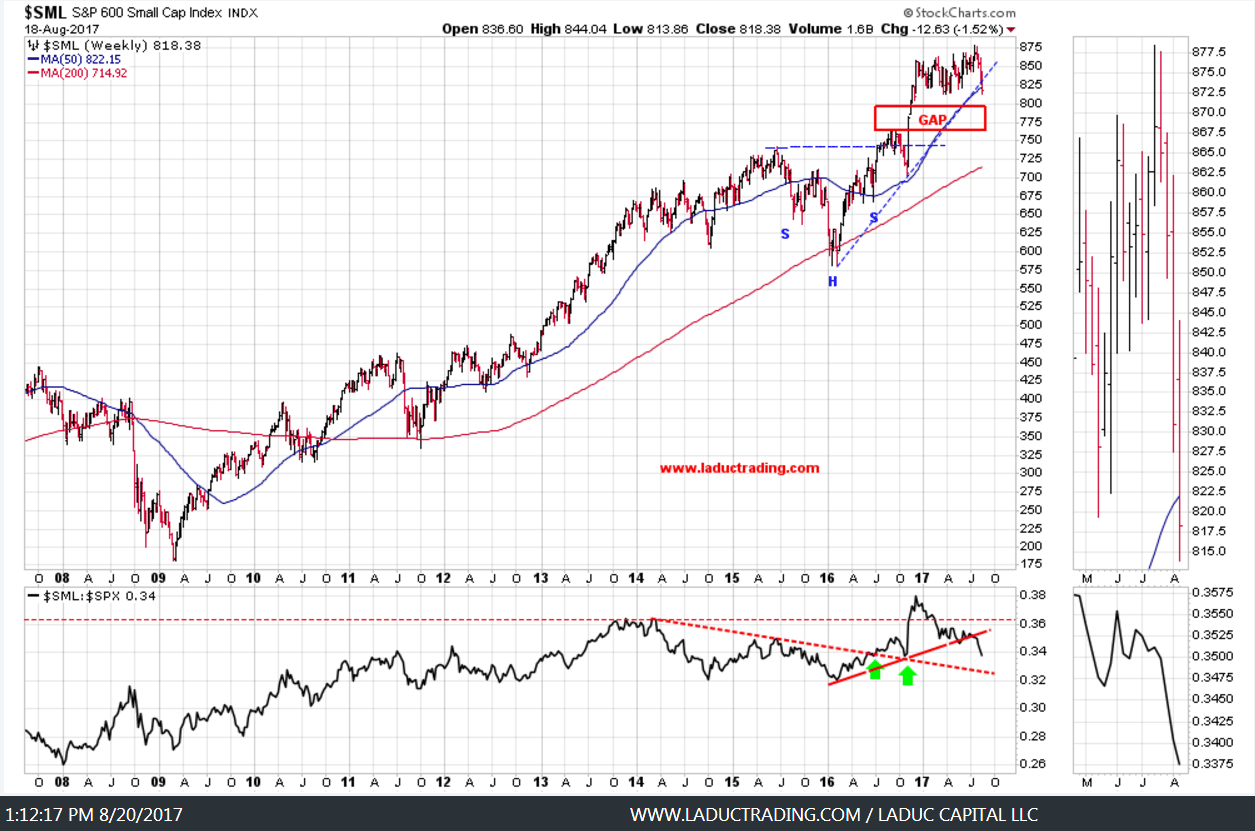

Small Caps Matter

I have been a Big Bear of IWM for a month, as regular readers of this newsletter, twitter and my trading room know. Three reasons: 1. Small cap speculation is needed to drive a market higher, 2. Small caps usually peak before large caps when nearing market tops, and 3. This chart screamed “Gap Fill!”:

Now that IWM has met my price target of $134 from $144 and is sitting on 50W, can it bounce? Absolutely. Will $139 likely get sold? Likely. Will we fill that very foreboding gap down to $127.72 which is also 100W? More than likely. Is it possible we will retest pre-election levels ~$118? That is entirely possible too. And I would contend, the move can happen to the downside as quickly as it rose–three weeks. We had a melt-up in November. There is no reason, at these lofty valuation levels and sentiment readings, with earnings out of the way and geopolitical/political conflict in the way, that we can’t melt-down, so best prepare to profit or protect.

August is living up to its reputation as one of year’s most volatile months and my call that we would have a pullback, with a bigger one expected for September. This doesn’t help: The De-Branding of a President

Expected Move

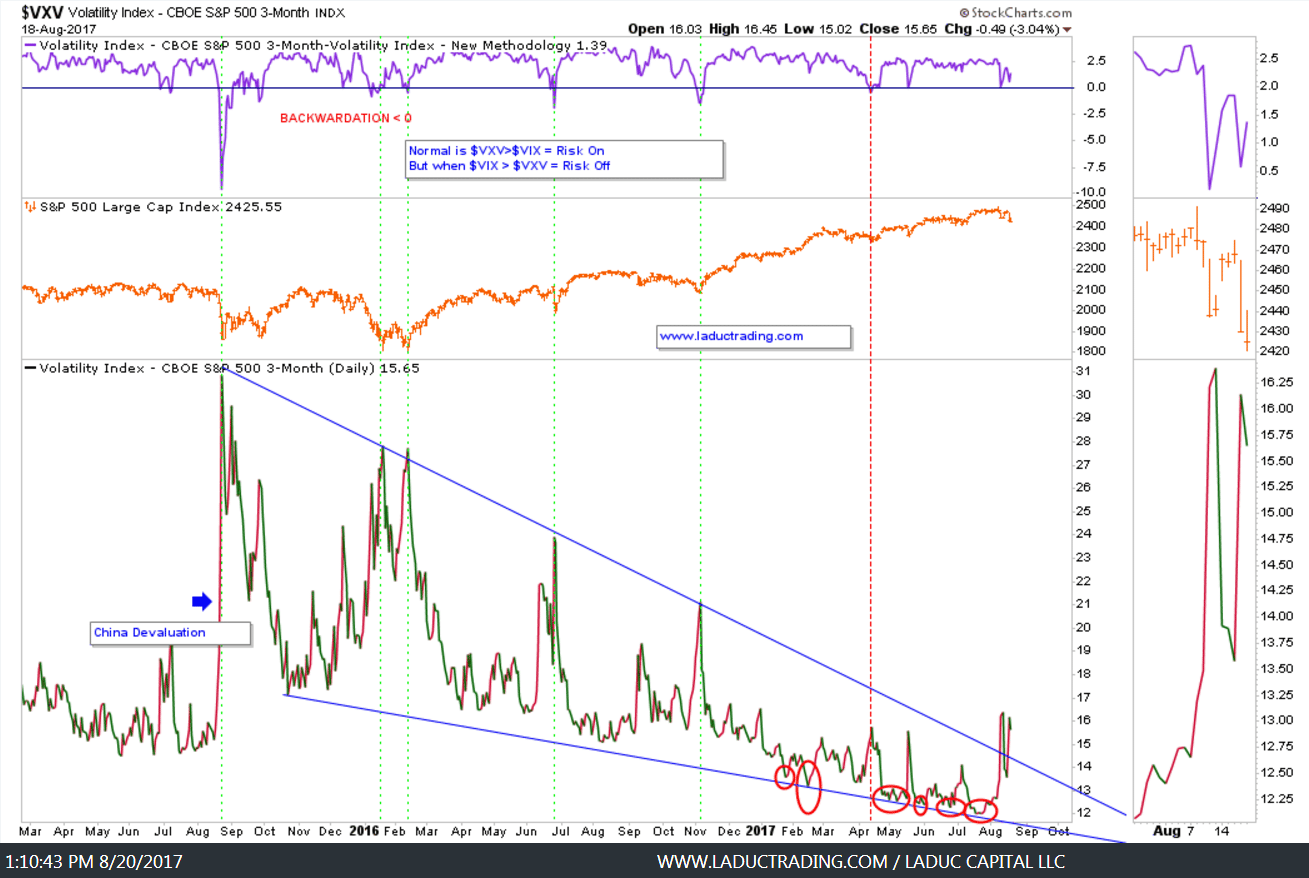

Last week market makers priced in a $41 move up or down from Friday’s SPX close; the market bounced $35 and then sold off hard. This coming week SPX is expecting a $34 move from $2425. The VVIX (volatility of volatility index)) is higher than it was on election night. Volatility has exploded into highs and not retreated in a significant way. My point: Volatility, moving forward, will be self-fulfilling.

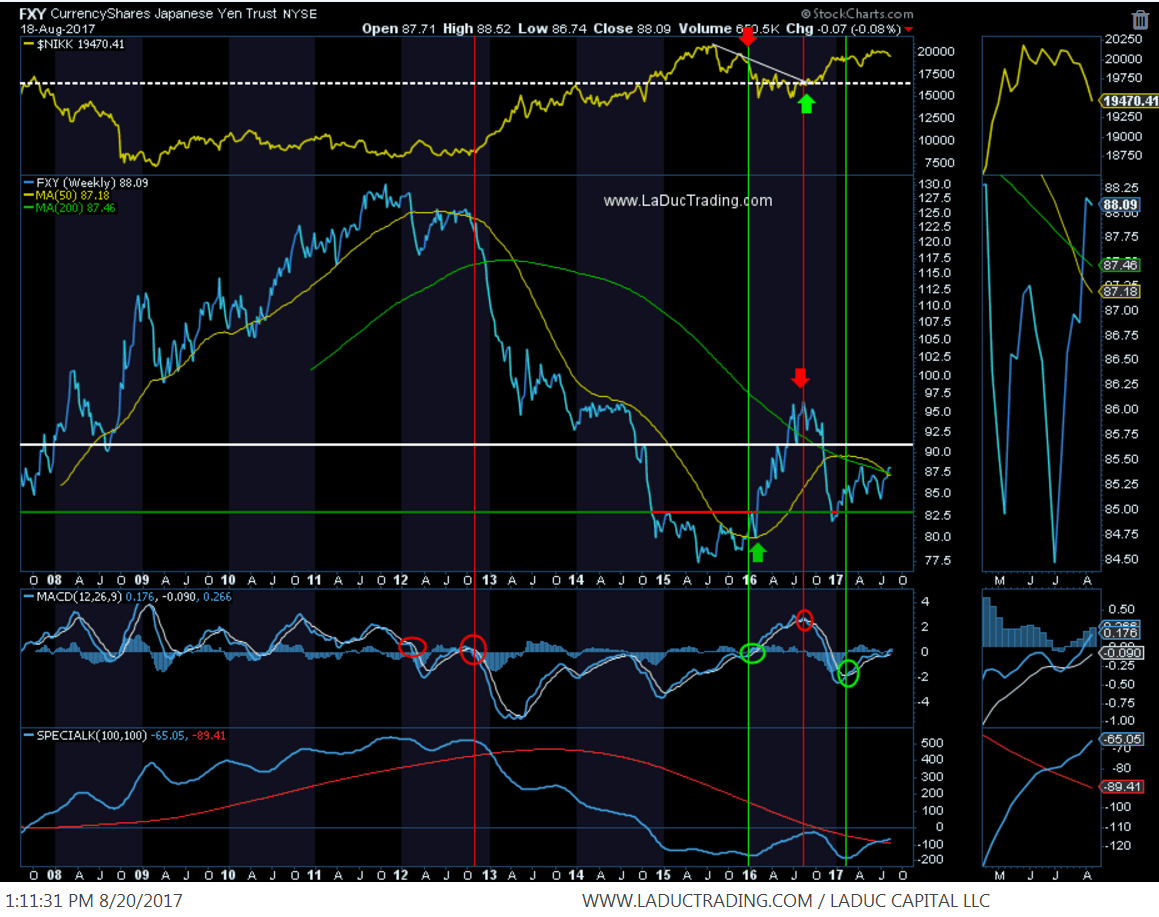

Japan is doing awesome. Time to sell Japan?

Japan released GDP figures showing that their economy grew 4% in 2Q17 vs. 2.5% estimated. Japan has enjoyed a streak of positive growth for 6 quarters in a row. They are beating Rest Of World (ROW) but have one of the most aggressive QE programs on the planet that could take 31 years to liquidate.

Previously I mentioned how a large Yen short isn’t going the right way. More to the point, if the Yen short carry trade starts to unwind, the confidence in BOJ starts to unwind, and the ‘Japan is growing more than ROW’ talk starts to cause BOJ to unwind it’s buying then this chart will make a whole bunch of sense:

Events This Week and How I’m Trading It

Economic Reports

All eyes on Jackson Hole. The annual Jackson Hole Symposium and economic conference will be held Thursday and gather the world’s central bankers. It culminates in press events with Yellan and Draghi on Friday, August 25th. It is assumed the USD and EUR will move not to mention rates–one way or the other! An announcement of strategy to unwind ECB stimulus would likely reverse the EUR strength but this is not expected. Retail and Tech earnings may illuminate but mostly they have sold off this season. We have PMI’s and a Eurozone GDP reports, but none matter as much as Debt ceiling and Cohn sentiment, both of which are in doubt and the market is clearly skiddish. In addition to the first total solar eclipse in 99 years visible for all of North American, we also have potential flares out of North Korea as they threaten further missile tests.

Monday: Total solar eclipse in North America

Tuesday: Germany ZEW Economic Sentiment, US API Crude Inventories, Japan Flash Manufacturing PMI

Wednesday: Eurozone Flash Manufacturing PMI’s, US New Home Sales, DOE Crude Inventories

Thursday: Spain GDP, UK GDP, US Initial Jobless Claims, Flash Manufacturing/Services PMI, Japan Tokyo Core CPI, National Core CPI

Friday: Germany GDP IFO Business Climate, France Consumer Confidence, Spain PPI, US Durable Orders

Earnings Releases

The stocks we have loved to swing trade last quarter have earnings this week: BZUN, MOMO, VEEV have been fun on the upside (now consolidating) and ULTA SIG to the downside. Just keep in mind: Earnings is a gamble without an edge, or a hedge.

#earnings $MOMO $BZUN $AVGO $CRM $LOW $ULTA $VEEV $TOL $WUBA $MDT $VMW $FN $BURL $AEO $ADSK $DLTR $ANF $DSW $TIF https://t.co/lObOE0uRjZ pic.twitter.com/xI7M50aBBf

— Earnings Whispers (@eWhispers) August 19, 2017

Member Trading Video

Member Trading Video will be sent separately with trading notes to accompany it.

And Thursday’s Special Video Release that reviews the Anatomy of a Macro-to-Micro Basket Trade of shorts, longs and hedges still applies!

Inflation Trade Conundrum: Flattening yield curve remains a key headwind for the Trump reflation trade theme not to mention a potential China Trade War. There is an argument to be had that the FAANMG holders will sell to buy commodities but with energy, materials and industrial metals weak, with the combination of lower sentiment and lower inflation likely to weaken yields and commodities, it is not safe to assume any asset class is safe. Cash is a position.

Macro Considerations

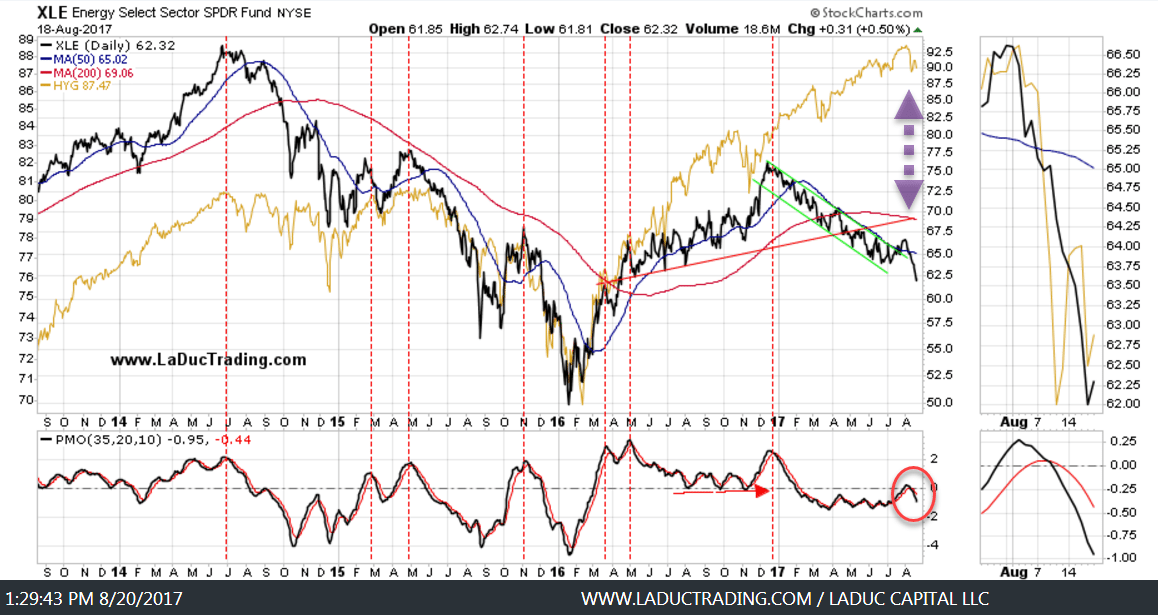

Dueling Charts: Oil Trade

Energy is indisputably the weakest sector this year along with Retail. For some Value Investors, this is exactly when to start buying.

Art Berman, an Oil+Gas Analyst, might disagree. After watching his more than insightful interview I surmised: 1. US is approaching tight supply, 2. US has limited export potential; 3. Rest of World is Oversupplied; 4. LNG prices likely to remain low and 5. There’s an accounting problem….

Might that accounting show up in High Yield Corporate Bonds? This chart, on many levels, is not bullish: from the divergence (purple arrow) to the falling indicator (red circle) to the falling prices! Just not seeing a floor yet in oil.

Eurodollar Liquidity

If the velocity of dollars drives global financial markets, and FED is slated to reduce its balance sheet in September, then will there be a shortage of dollars which prompts de-facto tightening? As noted below, “The resulting deterioration in dollar liquidity in the Eurodollar market should have significant ramifications for risk assets.” Interesting in its timing, the TED spread (EuroDollar spread), as warned last newsletter, has more than doubled in just the past three weeks.

Dollar liquidity deterioration in Eurodollar mkt could cause cause risk off.

Chart courtesy of @neels_heyneke and @MehulD108 of @NedbankCIB pic.twitter.com/rTzQKBA0ok— MacroVoices Podcast (@MacroVoices) August 16, 2017

Costs of Brinkmanship

The Government Accountability Office said that U.S. borrowing costs increased by $1.3 billion in 2011 because of the debt limit impasse that year, which also led to an unprecedented downgrade from S&P Global Ratings. With the next debt ceiling approaching, might the US default? Bond traders are taking no chances. Coincidentally, bearish bets against the US Dollar have climbed to the highest levels since 2013 – right before its 12% surge in 2014. Point is: Is risk priced in this time?

World Upgrade: IMF just announced we have experienced the “broadest synchronized upswing the world economy has experienced in the last decade.”

“Economic weakness will just mean more printing, it is economic strength that should worry the equity bulls.”

kevinmuir@

At LaDucTrading, I analyze price patterns and intermarket relationships across stocks, commodities, currencies and interest rates. I develop macro investment themes to identify tactical trading opportunities and employ strategic technical analysis to deliver high conviction stock, sector and market calls. My annotated Charts are meant to do most of the talking and illustrate my Thesis, Trigger, Time Frames, Trade Set-ups and Option Tactics. When applicable, I note Unusual Option Activity (UOA) and Deal Flow. I also keep a Tally and follow a Trade Plan, both of which are made available to members. No proprietary indicators are used, just solid chart pattern recognition, volatility insight and some big-picture perspective thrown in. Don’t hesitate to contact me with questions or comments: [email protected].

Feedback and Referrals

I value your feedback. Let me know how I can help!

I value referrals. Let others know I am here to help!

So You Know

Newsletter Subscriber? You can pop in for a morning or afternoon of LIVE Trading Room analysis and interaction. Or join for a whole day or week! Yes we have monthly subscriptions but point is, you get to chose when to access my real-time analysis and trade set ups of interest to you. You choose when to fish.

August Special

For the month of August, I am offering 50% off my LIVE Trading Room which includes my Gone Fishing Newsletter ($150/mo value).

Just enter 1STMO50OFF